CMG Company Overview

Chipotle Mexican Grill, a household name in the fast-casual dining scene, has come a long way since its humble beginnings. From a single Denver restaurant in 1993 to a global empire with thousands of locations, CMG’s journey is a testament to its commitment to quality ingredients, fresh food, and customer satisfaction.

History and Evolution

Chipotle’s story began with Steve Ells, a culinary school graduate who envisioned a restaurant serving high-quality, flavorful food at an affordable price. Inspired by the traditional Mexican cuisine he encountered during his travels, Ells opened the first Chipotle in a converted ice cream shop in Denver, Colorado. The restaurant’s focus on fresh, simple ingredients, prepared in an open kitchen, quickly resonated with customers, and Chipotle began expanding rapidly.

In 2006, Chipotle went public, and its stock soared, reflecting the company’s impressive growth and popularity. Throughout the years, Chipotle has continued to innovate and adapt, introducing new menu items, expanding its geographical reach, and focusing on sustainability and social responsibility.

Mission, Vision, and Core Values

Chipotle’s mission is to “Food With Integrity.” This mission statement encapsulates the company’s commitment to using only the highest quality ingredients, sourced responsibly and prepared with care. The company’s vision is to “change the way people think about and eat fast food.” Chipotle aims to offer a healthier, more sustainable alternative to traditional fast food, appealing to customers who value quality and taste.

Chipotle’s core values, “Food With Integrity,” “Cultivate a Better World,” and “People First,” guide the company’s operations and decision-making. These values are reflected in the company’s sourcing practices, employee benefits, and environmental initiatives.

Products and Services

Chipotle’s menu is simple yet versatile, featuring a limited number of core ingredients that can be customized to create a wide variety of dishes. The company’s signature menu items include:

- Burritos: A classic Mexican dish filled with rice, beans, meats, salsas, and other toppings.

- Burrito Bowls: A deconstructed burrito, with all the ingredients served in a bowl.

- Tacos: Soft or hard corn tortillas filled with meat, cheese, and toppings.

- Salads: A fresh and healthy option, with lettuce, rice, beans, meats, and toppings.

- Quesadillas: Folded tortillas filled with cheese, meats, and other fillings.

Chipotle also offers a variety of sides, including chips and guacamole, as well as beverages like sodas, teas, and bottled water.

Target Market and Customer Demographics, Cmg stock

Chipotle’s target market is primarily young adults and millennials, who are health-conscious, value fresh and high-quality food, and are willing to pay a premium for it. The company’s customer base is diverse, reflecting the changing demographics of the American population.

Current Market Position and Competitive Landscape

Chipotle is a major player in the fast-casual dining segment, competing with other popular chains like Panera Bread, Subway, and Qdoba. The company’s strong brand recognition, commitment to quality, and focus on customer experience have helped it maintain a competitive edge. However, Chipotle faces challenges from both established competitors and new entrants in the fast-casual market.

The company has been working to address these challenges by investing in technology, expanding its menu offerings, and improving its operational efficiency.

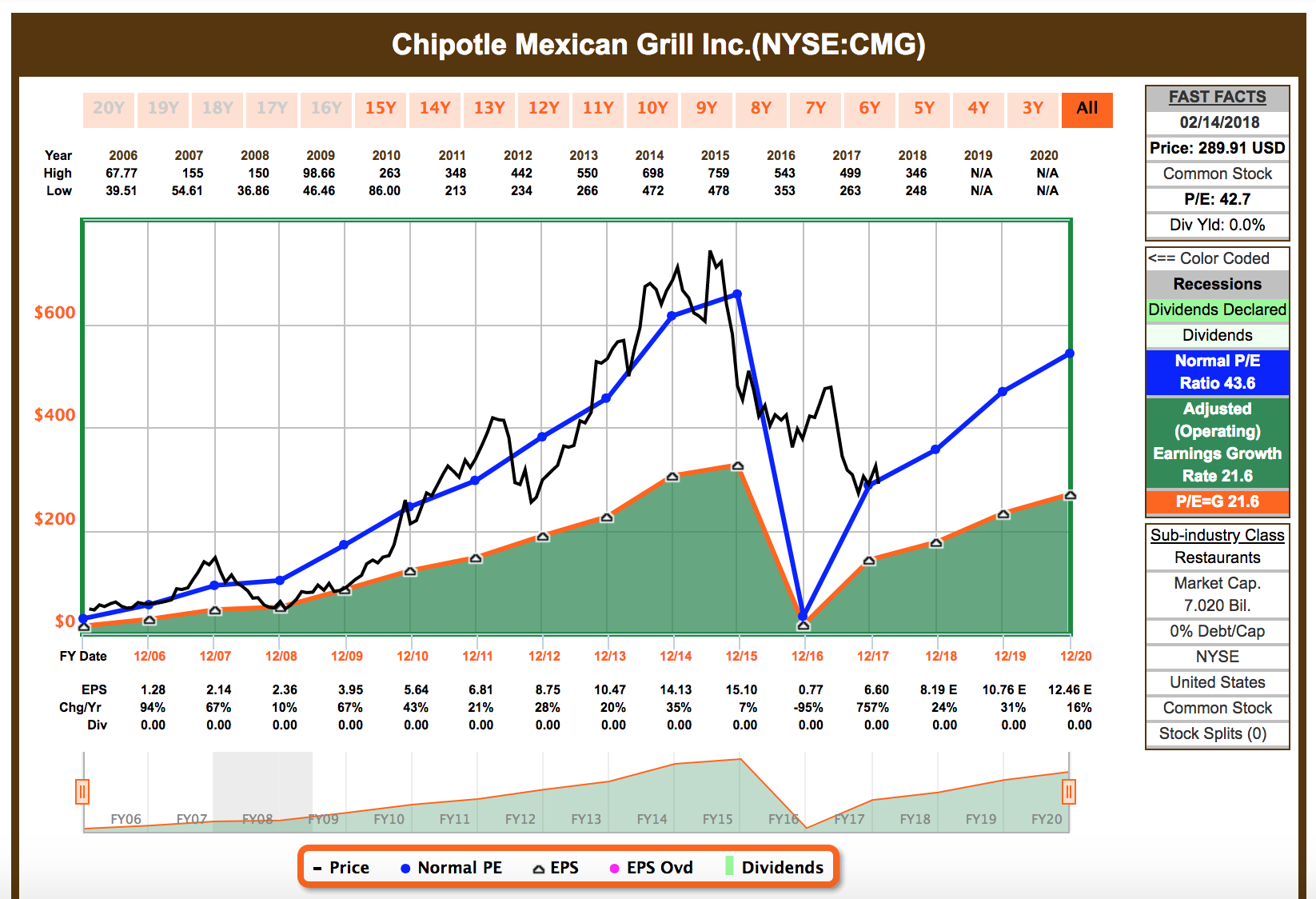

Financial Performance and Key Metrics

CMG’s financial performance has been consistently strong, driven by its dominant position in the fast-casual dining industry. The company has a proven track record of revenue growth, profitability, and shareholder value creation.

Revenue Growth and Profitability

CMG’s revenue has grown steadily over the past several years, fueled by new restaurant openings, menu innovation, and increased customer traffic. The company’s strong brand recognition, loyal customer base, and efficient operations have contributed to its consistent profitability.

Key Financial Ratios and Metrics

Several key financial ratios and metrics provide insights into CMG’s financial performance and health.

- Revenue per square foot: This metric reflects the efficiency of CMG’s restaurant operations. A higher revenue per square foot indicates that the company is effectively utilizing its space and generating revenue.

- Same-store sales growth: This metric measures the percentage change in sales at restaurants that have been open for at least a year. Strong same-store sales growth is a sign of healthy customer demand and brand loyalty.

- Operating margin: This ratio measures the profitability of CMG’s core operations. A higher operating margin indicates that the company is effectively controlling its costs and generating profits.

- Return on equity (ROE): This metric measures the profitability of CMG’s investments. A higher ROE suggests that the company is efficiently using its shareholder capital to generate profits.

Capital Structure and Debt Levels

CMG has a conservative capital structure with a low level of debt. The company’s strong cash flow generation allows it to fund its growth organically and maintain a healthy financial position.

Comparison to Competitors

CMG’s financial performance generally outperforms its competitors in the fast-casual dining industry. The company’s focus on quality ingredients, innovative menu items, and exceptional customer service has helped it maintain a competitive edge.

Significant Trends and Factors Influencing Financials

Several factors influence CMG’s financial performance, including:

- Consumer spending: Consumer confidence and disposable income levels directly impact restaurant sales. Economic downturns can lead to a decline in restaurant spending.

- Competition: The fast-casual dining industry is highly competitive, with new entrants and existing players constantly vying for market share. CMG must continue to innovate and differentiate its offerings to stay ahead of the competition.

- Food costs: Rising food costs can impact CMG’s profitability. The company must manage its supply chain and menu pricing effectively to mitigate the impact of rising food costs.

- Labor costs: Increasing minimum wages and labor shortages can put pressure on CMG’s operating costs. The company must invest in technology and employee training to address these challenges.

Growth Strategies and Future Outlook: Cmg Stock

CMG is known for its commitment to growth, and its future outlook is promising. Let’s break down its strategies and explore what’s in store for this popular chain.

Expansion Strategies

CMG has a multi-pronged approach to expansion, focusing on both physical locations and digital platforms.

- New Restaurant Openings: CMG continues to open new restaurants across the US and internationally, targeting areas with high growth potential. They’re also experimenting with smaller, more efficient restaurant formats, like “Chipotle Express” and “Chipotle Digital Kitchens.”

- Digital Expansion: CMG is heavily investing in its digital platforms, including its mobile app, online ordering, and delivery partnerships. They’re constantly improving their digital ordering and payment systems, enhancing the customer experience.

- International Growth: CMG has made significant strides in expanding internationally, with a strong presence in Canada, Europe, and the Middle East. They’re exploring new markets and adapting their menu to local preferences.

Restaurant Industry Growth Potential

The restaurant industry is a dynamic and constantly evolving sector. Here are some factors influencing its growth:

- Rising Disposable Income: As economies grow, consumers have more disposable income to spend on dining out, fueling demand for restaurants.

- Changing Consumer Preferences: Consumers are increasingly seeking convenient, healthy, and affordable dining options. This plays into CMG’s strengths, as they offer customizable meals and focus on fresh ingredients.

- Urbanization: Urbanization drives demand for restaurants as more people move to cities, leading to increased density and higher concentrations of potential customers.

Opportunities and Challenges

CMG faces both opportunities and challenges in the restaurant industry:

Opportunities

- Growing Demand for Fast Casual: Fast casual restaurants like CMG are gaining popularity due to their value proposition, offering higher quality food than fast food chains but at a faster pace than traditional sit-down restaurants.

- Innovation in Food and Technology: CMG can leverage technology to improve efficiency, enhance customer experience, and develop new menu items and delivery models.

- Sustainability: Consumers are increasingly conscious of sustainability, and CMG can position itself as a leader by focusing on sourcing ethical ingredients and reducing its environmental impact.

Challenges

- Competition: The restaurant industry is fiercely competitive, with new players emerging and established chains constantly innovating.

- Rising Labor Costs: Finding and retaining qualified staff is a major challenge for the restaurant industry, as labor costs continue to rise.

- Supply Chain Disruptions: Global supply chain disruptions can impact ingredient availability and costs, affecting restaurant operations.

Impact of Technological Advancements

Technological advancements are transforming the restaurant industry, and CMG is actively adapting to these changes.

- Digital Ordering and Payment: CMG’s digital platforms streamline the ordering and payment process, offering customers a seamless experience.

- Data Analytics: CMG uses data analytics to gain insights into customer preferences, optimize menu offerings, and improve operational efficiency.

- Automation: CMG is exploring automation technologies, such as robotic arms and self-checkout kiosks, to improve speed and accuracy in its kitchens.

Long-Term Growth Prospects

CMG’s commitment to innovation, its strong brand recognition, and its focus on customer experience position it well for continued growth in the long term.

- Expansion into New Markets: CMG has significant potential to expand into new domestic and international markets, tapping into untapped consumer bases.

- Digital Dominance: CMG’s digital strategy is likely to drive significant growth, as more consumers embrace online ordering and delivery.

- Sustainable Practices: CMG’s focus on sustainability can resonate with environmentally conscious consumers, giving it a competitive advantage.

CMG stock, the ticker symbol for Chipotle Mexican Grill, has seen its share price fluctuate in recent years. As with any publicly traded company, investor interest is often tied to the performance of the CEO, Brian Niccol. You can learn more about his compensation, including his brian niccol salary , which can provide insights into the company’s overall financial health and management strategy.

Ultimately, understanding the factors influencing CMG stock requires a comprehensive analysis of the company’s operations, its competitive landscape, and the broader economic environment.

CMG stock, representing Chipotle Mexican Grill, has been a popular investment choice for many, reflecting the company’s success in the fast-casual dining industry. It’s interesting to note that Brian Niccol, the current CEO of Chipotle, has a fascinating background in the entertainment industry.

To learn more about his journey, you can check out his Wikipedia page, brian niccol wiki , which details his involvement in films like “The Truman Show” and “Gattaca.” Niccol’s experience in storytelling and building compelling narratives likely contributes to his strategic vision for Chipotle, driving its growth and appeal to a wide customer base.